In today’s high-speed life sciences landscape, global expansion is as much about compliance as capability. It’s not just where you manufacture or ship, but whether your documents pass regulatory checkpoints without delays. In this piece, we’ll highlight the most promising international markets and show how a streamlined apostille document service can give your firm a competitive edge.

Global supply chains have transformed significantly since the COVID-19 pandemic. Pharma and med-tech firms are no longer just exporting products, they’re exporting operations: licensing, certifications, partnerships, clinical trial data, and intellectual property. All of this movement hinges on one critical factor: documentation that holds up under scrutiny abroad.

Authentication: Apostille vs Consular Legalization

When both the origin and destination countries are members of the Hague Apostille Convention (which includes over 120 nations), document authentication is as simple as an apostille, a fast, single-step certification.

However, if either country is outside the treaty, you’re plunged into consular legalization, a multi-step process involving notary, governmental, and embassy approvals that can add weeks to your timeline.

To check if the country is a Hague member or not, please check this page: Hague and Non-Hague Apostille Convention Countries

The most commonly authenticated documents include Good Manufacturing Practice (GMP) certificates, Certificates of Pharmaceutical Product (CPPs), commercial invoices, clinical trial authorizations, and CE markings for devices. Without proper authentication, these documents can be rejected outright, delaying approvals or shipments indefinitely.

Pharmaceuticals: Where’s the Demand?

United States

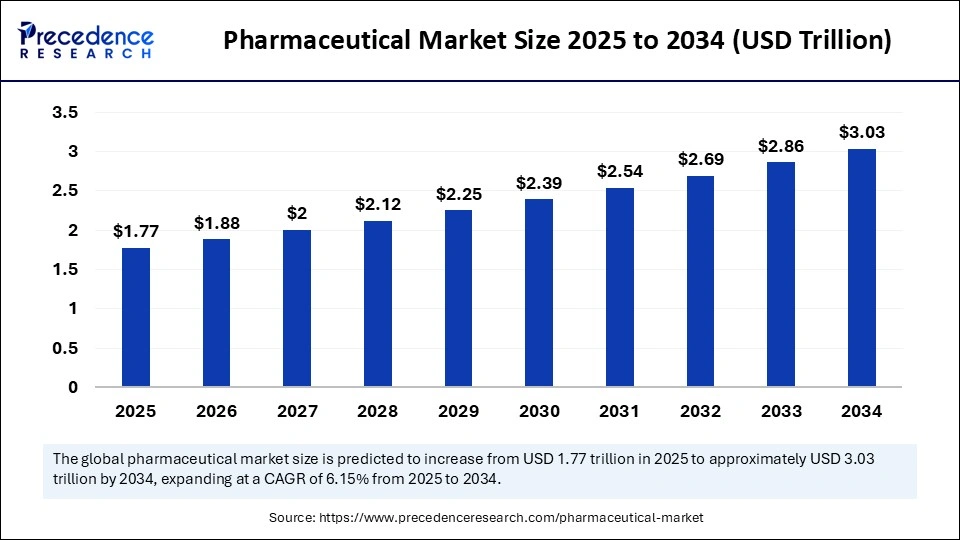

- The U.S. remains the world’s largest pharma market, valued at over $1.67 trillion in 2024 and expected to grow to $3.03 trillion by 2034 (CAGR ~6.15%).

- It’s a mature, high-regulation market, making proper authentication (especially via apostille when applicable) critical to seamless submissions to bodies like the FDA.

China

- China’s pharma market exceeded $160 billion in 2024 and is forecasted to hit $230 billion by 2028 (CAGR ~8–9%).

- The country accepts both apostilles and legalizations from non-Hague countries.

Germany & EU

- Germany leads Europe with a pharma market worth over $56 billion, including nearly $12 billion in exports to other EU countries.

- The broader EU pharma market totals around $330 billion.

- Since all of these countries are Hague members, apostille applies.

Japan

- With a pharma market of $95–100 billion, Japan ranks in the top 5 globally.

- It’s a Hague member, so apostille is an option for countries also in the treaty, meaning streamlined authentication when applicable.

Brazil

- Brazil clocks in at around $30 billion in pharma sales. It’s a key Latin American hub.

- Brazil, being Hague member, accepts apostilles.

Medical Devices: High Growth, High Stakes

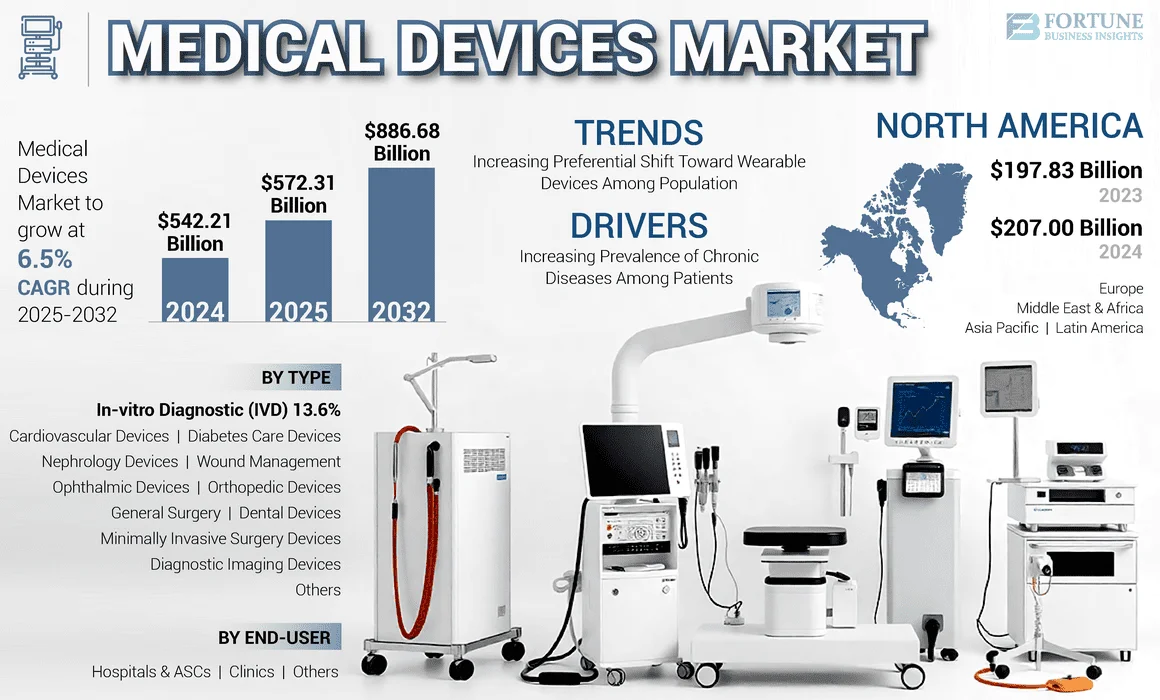

Source: Fortune Business Insights

United States

- The U.S. medical device market tops $180 billion, with growth projected at 5–7% annually.

- Navigating FDA approval often means heavy documentation. A smooth Apostille Document Service is key for Hague-member trade partners.

China

- At roughly $70 billion, China’s med-tech space is booming with a 7–10% growth rate.

- Stringent documentation rules make apostille, where applicable, well worth doing right the first time.

Germany & EU

- German medical device exports exceed $27 billion, making it a global export leader.

- The EU-wide device market is over $170 billion, and apostille rules apply broadly across treaty members.

South Korea & Japan

- South Korea’s market stands near $15 billion, while Japan is at $32 billion.

- Both are Hague members, so apostille is available for mutual document recognition, making export smoother.

India

- A rapidly expanding med-tech hub, India’s market is nearing $20 billion.

- India is a Hague member, so apostille applies for compliant document transfers with other member countries.

Why a Professional Apostille Document Service Makes Sense

- Time Savings: Apostille steps are faster than embassy or consulate legalization. In Hague-to-Hague routes, apostille can shave off days or even weeks.

- Mitigated Risk: Incorrect authentication can trigger costly regulatory rejections. A professional service helps ensure compliance the first time around.

- Scalability: Whether your pharma firm is entering Germany or your device startup is heading to Japan, having consistent authentication workflows (apostille when eligible; legalization otherwise) means fewer scheduling headaches.

Ready for Seamless Global Compliance?

Whether you’re expanding your pharmaceutical reach or navigating medical device entry into new countries, getting authentication right is non-negotiable. WCS can help. Our dedicated apostille document service ensures your documents meet the right standards, whether apostille or legalization, so your products get to market faster and more reliably.

Contact WCS today to set up your authenticated documentation process and make global expansion effortless.

Key Takeaways

- Top pharma markets: United States ($550B), China ($160B), EU/Germany ($330B/$56B), Japan ($95–100B), Brazil ($30B).

- Top medical device markets: U.S. ($180B), China ($70B), Germany/EU ($27B/$160B), Japan ($32B), South Korea ($15B), India (~$20B).

- Authentication matters: Authentication includes both apostille and legalization. Use apostilles when both countries involved are Hague members. Otherwise, use legalization.

- A specialized apostille document service helps streamline approvals, reduce export delays, and keep compliance tidy across high-growth global markets.